Discover Our Featured Listings

Luxury Apartments for Rent in Longacres, Lusaka

Longacres, Lusaka, Lusaka District, Lusaka Province, Zambia- Apartment, Flat, Furnished, Residential Property

Commercial Property for Sale in Makeni

Makeni, Lusaka, Lusaka District, Lusaka Province, 10101, Zambia- 2 acres

- Commercial Property, Land

Executive Serviced Apartments in Diplomatic Quarters

Chikwa Road, Cathedral Hill, Lusaka, Lusaka District, Lusaka Province, Zambia- Beds: 3

- Baths: 3.5

- Apartment, Flat, Furnished, Residential Property

Lovely 3 Bedroom Houses In Roma Park

Roma, Lusaka, Lusaka District, Lusaka Province, 10101, Zambia- Beds: 3

- Baths: 3

- 200 Sqmt

- 1147 Sqmt

- Single Family Home, Residential Property

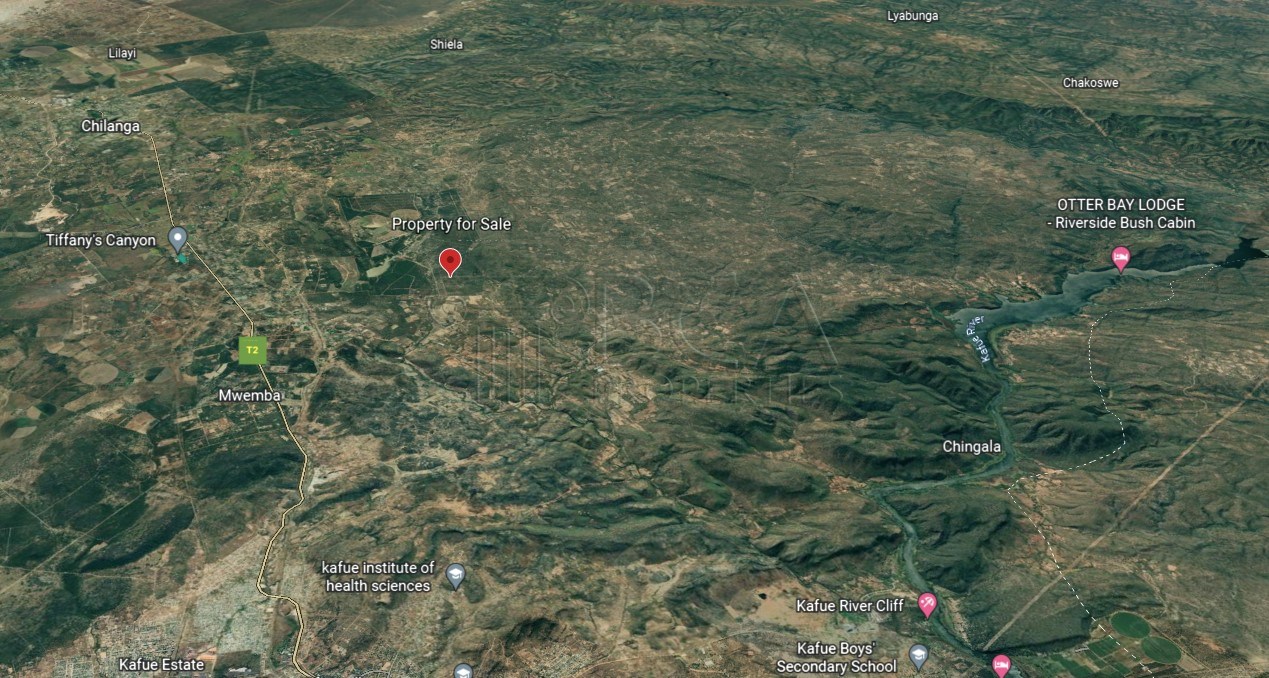

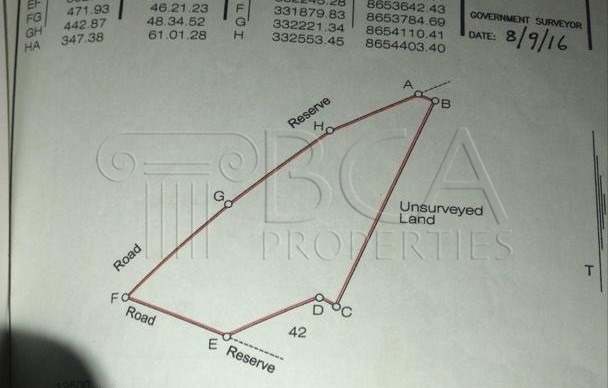

15-Acre Land for Sale in Shimabala Area

Kafue Road, Chilanga District, Lusaka Province, Zambia- Beds: 2

- Bath: 1

- 15 acres

- Land

Warehousing to Rent in Prime Locations

Lusaka, Lusaka District, Lusaka Province, 10101, Zambia- 2000 sq mt

- Warehouse, Industrial Property

Ideally Located Property to Let

Manda Hill, Great East Road, Rhodes Park, Lusaka, Lusaka District, Lusaka Province, Zambia- 3000 sqmt

- Commercial Property

Prime 40-Hectare Commercial Land for Sale in Kalumbila

Kalumbila, Solwezi District, North-Western Province, Zambia- 40 ha

- Commercial Property, Land